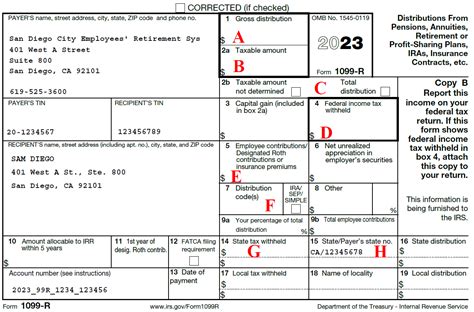

distribution code g in box 7 on 1099-r We would like to show you a description here but the site won’t allow us. Title: KM_C654e-20180801145218 Created Date: 8/1/2018 2:52:18 PM

0 · roth conversion 1099 r code

1 · form 1099 r code g

2 · form 1099 box 7 codes

3 · 1099 r with code g

4 · 1099 r form box g

5 · 1099 r distribution codes g

6 · 1099 r code g meaning

7 · 1099 r code 7m

There are three types of outdoor water heater enclosures: Frame-built enclosure: This style comes from a wood frame with metal panels on the outside and insulating material inside. A vinyl coating may also be of use to protect against weathering or corrosion.

What is distribution code "G" in box 7 on 1099-R? Yes, the Form 1099-R must be entered into TurboTax. The box 1 amount will appear on Form 1040 line 5a but the zero amount in box 2a means that none of this will be included in the taxable amount on line 5b.What is distribution code "G" in box 7 on 1099-R? Yes, the Form 1099-R must be .May 18, 2023 7:46 AM TurboTax is here to make the tax filing process as easy as .About form 1099-NEC; Crypto taxes; About form 1099-K; Small business taxes; .

We would like to show you a description here but the site won’t allow us. Use Code G for a direct rollover from a qualified plan, a section 403 (b) plan or a .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your .Use Code H in box 7. For all other distributions from a designated Roth account, use Code B in box 7, unless Code E applies. If the direct rollover is from one designated Roth account to .

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 .

roth conversion 1099 r code

7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code .

Form 1099-R Distribution Codes from Box 7. Detailed explanation. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions . What is distribution code "G" in box 7 on 1099-R? Yes, the Form 1099-R must be entered into TurboTax. The box 1 amount will appear on Form 1040 line 5a but the zero amount in box 2a means that none of this will be included in the taxable amount on line 5b.

Use Code G for a direct rollover from a qualified plan, a section 403 (b) plan or a governmental section 457 (b) plan to an eligible retirement plan (another qualified plan, a section 403 (b) plan, a governmental section 457 (b) plan, or an IRA). See Direct Rollovers in the IRS instructions for Form 1099-R for more information.The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.Use Code H in box 7. For all other distributions from a designated Roth account, use Code B in box 7, unless Code E applies. If the direct rollover is from one designated Roth account to another designated Roth account, also enter Code G in box 7. One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.

form 1099 r code g

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R.

cnc milling turning machine

7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 (Death) B . Form 1099-R Distribution Codes from Box 7. Detailed explanation. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Participant has not reached age 59 1/2, and there are no known exceptions under Code 2, 3, or 4 apply.

What is distribution code "G" in box 7 on 1099-R? Yes, the Form 1099-R must be entered into TurboTax. The box 1 amount will appear on Form 1040 line 5a but the zero amount in box 2a means that none of this will be included in the taxable amount on line 5b.Use Code G for a direct rollover from a qualified plan, a section 403 (b) plan or a governmental section 457 (b) plan to an eligible retirement plan (another qualified plan, a section 403 (b) plan, a governmental section 457 (b) plan, or an IRA). See Direct Rollovers in the IRS instructions for Form 1099-R for more information.The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

Use Code H in box 7. For all other distributions from a designated Roth account, use Code B in box 7, unless Code E applies. If the direct rollover is from one designated Roth account to another designated Roth account, also enter Code G in box 7. One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

form 1099 box 7 codes

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R.

7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 (Death) B .

1099 r with code g

1099 r form box g

1099 r distribution codes g

The grinding machine HELITRONIC RAPTOR is the ideal entry-level .

distribution code g in box 7 on 1099-r|form 1099 box 7 codes