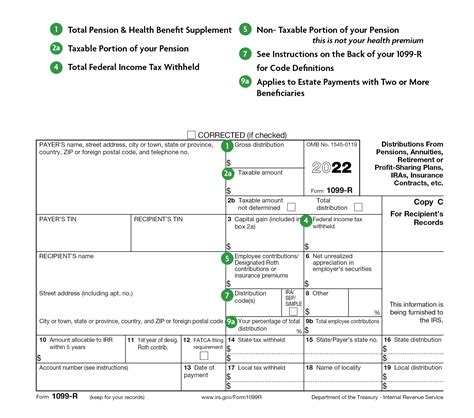

1099 r box 16 state distribution turbotax His 1099-R shows a taxable distribution in box 1 and 2 for fed taxes. However, box 16 (state distribution) does not show an amount. Does that mean this pension/retirement .

Why? Lyrics: Fools always ask me shit that I don't wanna answer / Does my mind have cancer, [for the rest I bring?] / Stay true to yourself, stay real, why do I do the things I do? / I'm on

0 · is a 1099 r taxable

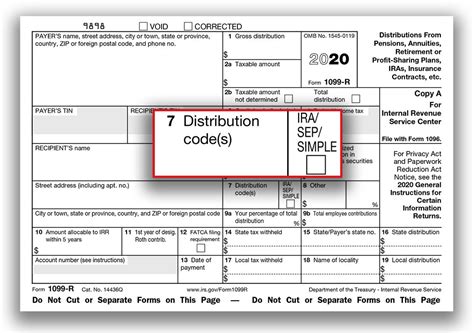

1 · irs 1099 r distribution codes

2 · irs 1099 r 2023

3 · internal revenue service 1099 r

4 · gross distribution on 1099 r

5 · 1099 r form pdf

6 · 1099 r boxes explained

7 · 1099 r box 16 blank

Use this worksheet to check your 3rd grade students’ understanding of using distributive property to solve problems. 15 questions with answers to identify areas of strength and support! How does this property relate to 3rd grade math? Apply properties of operations as strategies to multiply and divide. 4 \times 6 = 24 4 × 6 = 24 is also known.

If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State ID number, so that Boxes 14, 15, and 16 .

If Box 14 shows State Tax withheld, the Distribution Amount (Box 1) should be .His 1099-R shows a taxable distribution in box 1 and 2 for fed taxes. However, box .

If your Form 1099-R does not have an amount in box 16 for a state distribution, but there is an amount in box 14 for state tax withheld, then the review message thinks there should be .

If Box 14 shows State Tax withheld, the Distribution Amount (Box 1) should be entered in Box 16. If no state tax was withheld, you can delete the State ID number , so that . His 1099-R shows a taxable distribution in box 1 and 2 for fed taxes. However, box 16 (state distribution) does not show an amount. Does that mean this pension/retirement .In 2019, the "State tax withheld" amount was box 12 on form 1099-R. In 2020, it's box 14. TurboTax is disallowing my 2020 return, saying the amount in box 12 is invalid, yet displaying .

If Box 16 on your 1099-R is blank, it's typically because it may not be applicable for your state or specific situation. One workaround might be to enter In researching this problem, here is what I’ve found: If your 1099-R has a state withholding in Box 14, you must enter Line 15 and 16 as well. If your 1099-R does not have a state payer number, ..00 in Box 16 if TurboTax insists on . In this video I go through how to report Retirement Income from a IRS Form 1099-R on TurboTax. This specific video is from 2021 tax year however the software. Answered: 1099-R Taxable distribution in box 2a. Also NY state tax withheld $'s in box 14, but state tax distribution in box 16 blank. Proseries will

The instructions for preparers of Form 1099-R state "Generally, you must enter the taxable amount in box 2a. However, if you are unable to reasonably obtain the data needed to . If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State .If your Form 1099-R does not have an amount in box 16 for a state distribution, but there is an amount in box 14 for state tax withheld, then the review message thinks there should be something in box 16. If Box 14 shows State Tax withheld, the Distribution Amount (Box 1) should be entered in Box 16. If no state tax was withheld, you can delete the State ID number , so that Boxes 14, 15 and 16 are blank.

His 1099-R shows a taxable distribution in box 1 and 2 for fed taxes. However, box 16 (state distribution) does not show an amount. Does that mean this pension/retirement income was not taxable at state level? In 2019, the "State tax withheld" amount was box 12 on form 1099-R. In 2020, it's box 14. TurboTax is disallowing my 2020 return, saying the amount in box 12 is invalid, yet displaying box 14 for me to fix it.

is a 1099 r taxable

If Box 16 on your 1099-R is blank, it's typically because it may not be applicable for your state or specific situation. One workaround might be to enter In researching this problem, here is what I’ve found: If your 1099-R has a state withholding in Box 14, you must enter Line 15 and 16 as well. If your 1099-R does not have a state payer number, it is possible that they do not have one. Not every payer of retirement distributions has obtained payer numbers for every state..00 in Box 16 if TurboTax insists on having a number there.I have a 1099 R for an inherited Ira. Box 14 has state tax withheld but there is nothing on box 16, state distribution.In this video I go through how to report Retirement Income from a IRS Form 1099-R on TurboTax. This specific video is from 2021 tax year however the software.Customer: I have a 1099 R for an inherited Ira. Box 14 has state tax withheld but there is nothing on box 16, state distribution. My tax program says that box 16 must be greater than box 14. How do I find out what box 16 should be?

wood and steel planter boxes

If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State .If your Form 1099-R does not have an amount in box 16 for a state distribution, but there is an amount in box 14 for state tax withheld, then the review message thinks there should be something in box 16.

If Box 14 shows State Tax withheld, the Distribution Amount (Box 1) should be entered in Box 16. If no state tax was withheld, you can delete the State ID number , so that Boxes 14, 15 and 16 are blank.

wood and steel spice cabinet

irs 1099 r distribution codes

His 1099-R shows a taxable distribution in box 1 and 2 for fed taxes. However, box 16 (state distribution) does not show an amount. Does that mean this pension/retirement income was not taxable at state level? In 2019, the "State tax withheld" amount was box 12 on form 1099-R. In 2020, it's box 14. TurboTax is disallowing my 2020 return, saying the amount in box 12 is invalid, yet displaying box 14 for me to fix it.If Box 16 on your 1099-R is blank, it's typically because it may not be applicable for your state or specific situation. One workaround might be to enter In researching this problem, here is what I’ve found: If your 1099-R has a state withholding in Box 14, you must enter Line 15 and 16 as well. If your 1099-R does not have a state payer number, it is possible that they do not have one. Not every payer of retirement distributions has obtained payer numbers for every state..00 in Box 16 if TurboTax insists on having a number there.

I have a 1099 R for an inherited Ira. Box 14 has state tax withheld but there is nothing on box 16, state distribution.

In this video I go through how to report Retirement Income from a IRS Form 1099-R on TurboTax. This specific video is from 2021 tax year however the software.

irs 1099 r 2023

On-demand motorcycle parts fabrication via CNC machining, injection molding, and more. Get an instant quote and get started on your project right now.

1099 r box 16 state distribution turbotax|is a 1099 r taxable