k-1 box 19 distributions 1120s Form 1120S Schedule K-1 Line 19 is used if the S-Corp has more than one activity for passive activity purposes. You should have also received a supplemental statement to help . Aluminum extrusion, aluminum forging, CNC aluminum milling, CNC aluminum turning, CNC aluminum drilling, reaming and tapping. Davantech is recognized by its customers around the globe as a thrustworthy supplier and of custom made mechanical components and assemblies.

0 · s corp 1120s schedule k 1

1 · k1 1065 box 19

2 · k 1 1065 distribution

3 · box 19 of k 1

4 · 1120s shareholder distribution report

5 · 1120s schedule k 1 shareholder distribution

6 · 1120s schedule k 1

7 · 1120 form k 1

$3.70

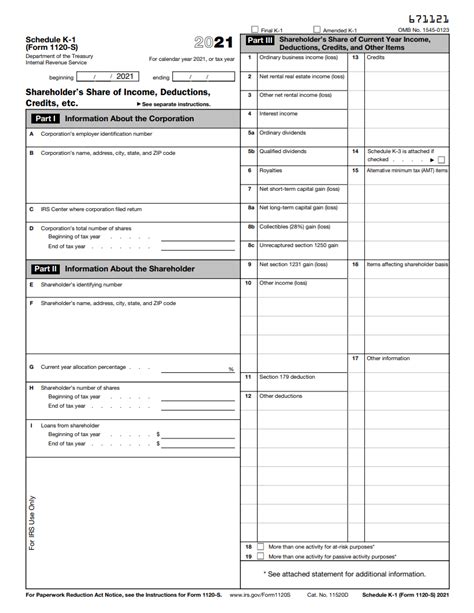

General Instructions. Purpose of Schedule K-1. The corporation uses Schedule K-1 to report your share of the corporation's income, deductions, credits, and other items. Keep it for your records. Don't file it with your tax return unless backup withholding is reported in box 13 using code O. Form 1120S Schedule K-1 Line 19 is used if the S-Corp has more than one activity for passive activity purposes. You should have also received a supplemental statement to help . I'm a shareholder of an S-Corp. In 2020, the S-Corp distributed some money to me as owner drawing. In Form 1120S Schedule K-1 Box 16 - Items Affecting Shareholder's Basis, .If you own an S corp or share ownership in one with others, you can expect to receive Form 1120S K-1 at the end of the year. Here’s how you use it.

Title. 2022 Shareholder_s Instructions for Schedule K-1 (Form 1120-S) Author. brenda. Created Date. 2/1/2023 1:37:48 PM.

Form 1120-S - Withdrawal to Shareholders. Each shareholder's distribution amount for the corporation's fiscal year should be reported on Schedule K-1, Line 16, with a reference code of .

Purpose of Schedule K-1. The corporation uses Schedule K-1 to report your share of the corporation's income, deductions, credits, and other items. Keep it for your records. Don't file it .

LLC and S-Corp entities need to know the requirements for filing their taxes. For S-Corps, they must complete and file Form 1120-S and Schedule K-1 for each shareholder. This form reports the company's income, . The K-1 for the 1120-S starting in 2020 has boxes for number of shares at beginning and end of tax year. The 2021 K-1 wants the shareholder's number of shares as well as the .

The Form 1120S Schedule K-1 is an essential tax document for this purpose, as it details each shareholder’s share of income, losses, deductions, and credits from the S corporation. In most cases, S corporation distributions are not .Box 19. Distributions. For 2023, partners receiving distributions of property from a partnership in a liquidating or non-liquidating distribution under certain circumstances must attach a statement to their tax return. See Box 19. Distributions, later. Box 20. Other information. Code AH, Other information, previously included a number of .

Your partnership received a distribution from another partnership; the K-1 you provide your partners should only reflect the distributions they received from you. On your trial balance, those distributions from the other partnership should match the distributions you booked as a reduction of (credit to) "Investment in Other Partnership."

Schedule K-1 for partnerships reports distributions to the partners in box 19A. Since you have to report your share of the partnership income or loss for the tax year whether or not the income is distributed to you in the same year, the amount of your distribution is not usually reported on your tax return for the year it is distributed.Distributions from an S Corp are generally untaxed -- they are not income. They affect basis and will be reported on the K-1 (box 16 code D). Income, reported on the K-1 (box 1 generally and presumably what you're asking about) and included on your tax return, is recognized when the business turns a profit regardless of whether that profit is distributed to anyone. This is why .Box 19 of the K-1 (1065) records distributions made to you, the partner or member, during the year. The distributions could have been cash or in other types of . Box 19 of the K-1 (1065) . Form 1120S Schedule K-1 Line 19 is used if the S-Corp has more than one activity for passive activity purposes. You should have also received a .

Customer: I have a C Corp (filing 1120) that received a K-1 from a partnership. I understand that income and loss would be reported on lines 10 and 26, respectively. Where do items from boxes 12 (section 179 deduction), 18 (tax-exempt income and nondeductible expenses), etc. from the K-1 get reported on the C Corp's 1120?Box 15. Credits. Box 19. Distributions. Box 20. Other information. Box 20, code P. Box 20, code X. Reminders. Domestic partnerships treated as aggregates for purposes of sections 951, 951A, and 956(a). Line 16. International transactions notice requirement. Individual retirement account (IRA) partners. General Instructions. Purpose of Schedule K-1I also contributed cash to the S-Corp in 2020, so should the amount for 1120S Schedule K-1 Box 16D be my net cash distribution (cash distributed - cash contributed)? I noticed that on my personal income tax return using TurboTax, entering the 1120S Schedule K-1 Box 16D amount reduces my Qualified Business Income deduction, dropping my QBI a lot .

Based on the election that the taxpayer makes, to have the correct amount flow to Schedule E (Form 1040), line 28 or to Form 8582, a separate entry should be made on the K-1 1120-S Screen identifying the item as a Section 59(e) expenditure. In this blog, we will take a closer look at K-1 distributions and whether they are considered taxable. Wealth Management Gap; Our Process; Financial Advisors; Resources; The Company; Articles; Register. . the information on the K-1 is used to complete Form 1065 (partnership tax return), Form 1120-S (S-corporation tax return), or Form 1041 . 1120s /S-corp question, How do I get to line 17c on 1120s schedule K for "dividend distributions paid from accumulated earnings and profits" on Turbotax Business/S-corp? You can enter that figure in Forms Mode directly on your 1120-S in Schedule K on page 3 (Other Information). View solution in original post March 4, 2020 8:12 AM.for Schedule K-1 (Form 1120-S) Shareholder's Share of Income, Deductions, Credits, etc. . 19 Box 16. Items Affecting Shareholder Basis ...19 Box 17. Other Information ...20 Box 18. More Than One Activity for At-Risk . Distributions. Inconsistent Treatment of Items. Generally, you must report corporate

The distributions are the withdrawals a shareholder makes from the cash that’s available. Let’s say the profit is 100k. This amount is reported on box 1 of the K-1 and the shareholder will pay the tax on their personal tax return. The shareholder can withdraw as a distribution the. 100k. The distribution is reported on box 19 of the K-1Box 19 of the K-1 (1065) records distributions made to you, the partner or member, during the year. The distributions could have been cash or in other types of . Box 19 of the K-1 (1065) . Form 1120S Schedule K-1 Line 19 is used if the S-Corp has more than one activity for passive activity purposes. You should have also received a .Box 19. More Than One Activity for Passive Activity Purposes...18 List of Codes . Schedule K-1 (Form 1120-S) and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form1120S. General Instructions Purpose of Schedule K-1 The corporation uses Schedule K-1 to report your share ofbox 18 and box 19. Reminders Qualified business income deduc-tion. Individuals and some estates . Schedule K-1, box 16, code D, minus (b) the amount of such distributions in excess of the basis in your stock. 3. Basis is decreased (but not .

for Schedule K-1 (Form 1120S) Shareholder's Share of Income, Deductions, Credits, etc. . Schedule K-1, box 16, code D, minus (b) the amount of such distributions in excess of the basis in your stock. 3. Basis is decreased (but not below zero) by .Schedule K-1, notify the partnership and ask for a corrected Schedule K-1. Don't change any items on your copy of Schedule K-1. Be sure that the partnership sends a copy of the corrected Schedule K-1 to the IRS. Decedent’s Schedule K-1. If you're the executor of an estate and you have received a

Under S-corps, Partnerships, and Trusts [in desktop: Business Investment and Trust Income], click on the Update box next to Schedule K-1. On the Tell Us About Your Schedules K-1 screen, click on the Start/Update box next to S corporations (Form 1120S). If you have already entered K-1 SCorp information, you will see the SCorp. K-1 Summary screen .

As an S-Corporation (S-Corp) owner, understanding the distinctions between W-2 wages, distributions, and K-1 profits is essential. Stay Ahead of Law Changes & Protect Yourself Against Being Audited . (Form 1120S) and provides the necessary information for completing your personal tax return (Form 1040). The K-1 represents your share of the . S corporations and some LLCs pass gains and losses on to their shareholders, who are then taxed at the tax rates for individuals. S corporations and some LLCs use IRS Form 1120S, Schedule K-1, for filing federal income tax returns for the corporation. The shareholder’s share of income or loss is carried over to IRS Form 1040, Schedule E.To enter a K-1 (Form 1120S) in TaxSlayer Pro from the Main Menu of the Tax Return (Form 1040) select: Income Menu; Rents, Royalties, Entities (Sch E, K-1, 4835, 8582) K-1 Input - Select 'New' and double-click on Form 1120S K-1 (S Corporation) which will take you to the K-1 Heading Information Entry menu. All information in this menu must be .Instructions Form 1120-S Schedule K-1 for John Parsons Schedule K-1 for George Smith Form 1120-5 Complete the Form 1120-s for Premium, Inc Notu: You are not required to complete Form 1125-A Cost of goods cold Form 1120-5 U.S. Income Tax Return for an S Corporation OMB NO. 1545-0123 Do not file this form unless the corporation has filed or .

Page 1 of 14 Instructions for Schedule K-1 (Form 1120S) 11:18 - 21-DEC-2006 . reported on Schedule K-1, depletion) over the basis of the box 16, code D. Additional Information property subject to depletion. 3. Basis is decreased by (a) . Distributions of money and the fair market value of property year) .K-1 Earnings; Schedule K-1 Form 1065; Credit and Other Information; This section of the program contains information for Part III of Schedule K-1 1065. Please be aware that the program does not allow for direct entries for all Box 14-20 information. You can review this article for any Box 20 codes that are not included in the Schedule K-1 entry. You will have to create the K-1 in the S-Corp section and then delete the K-1 from the Partnership section. When entering the information, please make sure you use the correct K-1 entry form. There are actually three types of K-1s, depending on the type of entity creating the K-1: partnership, S-corporation and trust/estate.

Solved: The K-1 for the 1120-S starting in 2020 has boxes for number of shares at beginning and end of tax year. The 2021 K-1 wants the shareholder's number of . (now Box G) on the K-1. What one needs for a non-dividend distribution (Box 16 code D) that now triggers requiring form 7203 is basis, and none of these K-1 boxes provide that. .

abbreviation junction box

$48.56

k-1 box 19 distributions 1120s|s corp 1120s schedule k 1