irs box 7 distribution codes If two or more other numeric codes are applicable, you must file more than one Form 1099-R. For example, if part of a distribution is premature (Code 1) and part is not (Code 7), file one Form . $349.99

0 · what is distribution code 7d

1 · irs code 7d on 1099

2 · ira normal distribution code 7

3 · form 1099 r code 7d

4 · form 1099 box 7 codes

5 · box 7 codes 1099 r

6 · 1099r box 7 code j

7 · 1099 form distribution code 7

Zwolf Metal Wall Mount Bracket for Wyze Cam Pan V3 / Cam Pan V2, Extend Cam pan v3 Coverage Make it Provide Better Viewing Angles Maximizing Coverage Reduce Blind Spots (Pack of 2)

Use Code H in box 7. For all other distributions from a designated Roth account, use Code B in box 7, unless Code E applies. If the direct rollover is from one designated Roth account to another designated Roth account, also enter Code G in box 7.File Form 1099-R for each person to whom you have made a designated distribution .If two or more other numeric codes are applicable, you must file more than one .If two or more other numeric codes are applicable, you must file more than one Form 1099-R. For example, if part of a distribution is premature (Code 1) and part is not (Code 7), file one Form .

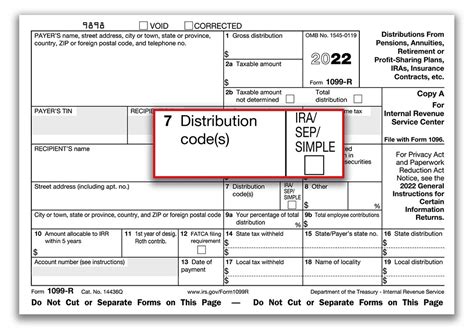

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply . Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, . L (Deemed Distribution from Loan) P (Taxable in prior year of the 1099-R year—the year the refunded contribution was made) Code 7: Normal distribution. The distribution is after .

Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution? Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. Code Explanation Used with, ifapplicable .

The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form . When you receive a Form 1099-R for a retirement or pension distribution, you’ll notice that Box 7 contains a distribution code. . Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, exempt from penalties, or rolled . Box 7 is used to report income to you. The different codes within box 7 tell what the tax treatment of any distribution amounts should be. 7 is the code for Normal Distribution (which means it was distributed to taxpayer after age 59.5). D .

Box 7 of IRS Form 1099-R is used to indicate the distribution code that corresponds to the type of distribution you received from a retirement plan, which determines whether it’s a taxable or non-taxable event. . Code 7. Use . Content Submitted By Ascensus. One of the most difficult aspects of reporting IRA and qualified retirement plan (QRP) distributions is determining the proper distribution codes to enter in Box 7, Distribution code(s), on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. Consider the following .early distribution tax and that can be repaid. See Table 1. Guide to Distribution Codes, later Form 5498 New repayment code. We have added code “BA” for reporting a repayment of a qualified birth or adoption distribution. See the instructions for Box 14a. Repayments and Box 14b. Code, later. Required minimum distributions (RMDs). The Yes, rolling over a 403(b) to a Roth 403(b) plan is a taxable event and code 7 (normal distribution) is the correct code for box 7. The reason this is taxable is that the original 403(b) is a tax-deferred account and the Roth 403(b) isn't a tax-tax-deferred account.

what is distribution code 7d

In the follow-up to entering the code 2B Form 1099-R, you must indicate that the distribution is NOT from a Roth IRA. TurboTax needlessly asks this question which serves only as an opportunity to make a mistake in answering since code B already explicitly indicates that the distribution from a Designated Roth Account in a qualified retirement plan, not from a Roth IRA.7. Normal distribution. Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 591/2; (b) for a Roth IRA conversion if the participant is at least age 591/2; and (c) to report a distribution from a life insurance, annuity, or endowment . Defining 1099-R Codes. Your age dictates the 1099-R conversion code, which appears in box 7 “Distribution code(s).” If you have not yet reached age 59 1/2, your custodian will place a “2 . 2 (Early Distribution - not subject to 10% early distribution tax) 4 (Death) 7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution)

Distribution Code Table entries on Form 1099 on Box 7. amounts reported on Form 1099-R. Description of Codes in Box 7. 15 Tax Calculators . for information on distributions that may be subject to the 10% additional tax; A distribution from a qualified retirement plan after separation from service in or after the year the participant has .

I received a 1099R with Box 7 containing codes D7. On source screen do I select "qualified IRA" or "None of the Above"? Also noted that when reviewing the screen, "None of the Above" is changed to " distribution before retirement". Is this normal? Review was made by going through update process, not.

You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) found in Box 7, which is the distribution code(s) box of your Form 1099-R. Who completes Form 1099-R? For the reason of COVID-19, do I have to provide proof to IRS? and the box 7 distribution code is 2 for that right? No you are not required to provide proof to the IRS. Why the Payer entered a code 2 in box 7 of the 1099-R can only be answered by the Payer.

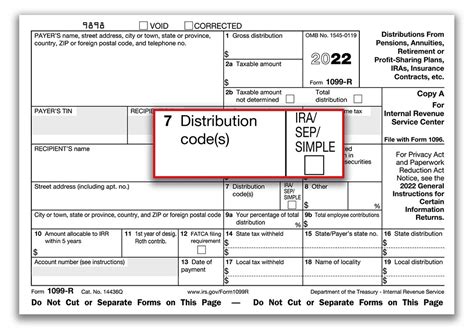

amount will be shown in this box and Code W will be shown in box 7. You need not report these amounts on your tax return. Box 2a. This part of the distribution is generally taxable. If there is no entry in this box, the payer may not have all the facts needed to figure the taxable amount. In that case, the first box in box 2b should be checked.Ah, got the answer. Per IRS' instructions at the back of the 1099-R form: If a charge or payment was made against the cash value of an annuity contract or the cash surrender value of a life insurance contract for the purchase of qualified long-term care insurance, an amount will be shown in this box and code W will be shown in box 7. You need not report these amounts on .

7 Distribution code(s) IRA/ SEP/ SIMPLE 8 Other $ % 9a Your percentage of total distribution % 9b Total employee contributions $ 10 Amount allocable to IRR . You need not report these amounts on your tax return. If code C is shown in box 7, the amount shown in box 1 is a receipt of reportable death benefits that is taxable in part.

Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding and

7 . Distribution code(s) IRA/ SEP/ SIMPLE. 8 . Other $ % 9a . Your percentage of total. 9b. distribution % Total employee contributions $ 12 . State tax withheld $ $ . You need not report these amounts on your tax return. If code C is shown in box 7, the amount shown in box 1 is a receipt of reportable death benefits that is taxable in part. Box 7 codes were P and J . . The code-J distribution in 2022 corrects this excess and will reduce the ,000 excess carried into 2022 from 2021 to zero on the 2022 Form 5329. . In the case of a return of contribution from a Roth IRA before the due date of the tax return, code J is always present to indicate that the distribution is from a . One of the most difficult aspects of reporting IRA and qualified retirement plan (QRP) distributions is determining the proper distribution codes to enter in Box 7, Distribution code(s), on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. Consider the following common IRA and QRP .

Some reporting agencies put a qualifying explanation with a second code in box 7b when box 7(a) code is 2. This is because a box 2 code is that you don't have a penalty for the early distribution, but that box doesn't say why. Box 7b does give the explanation with a code. But it is not required for the issuing agency to put this information. Here's some info about the codes in Box 7: The code(s) in Box 7 of your 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions, to determine if your distribution is taxable or subject to an early withdrawal penalty. Box 7 Distribution Codes: 1 – Early distribution (except .

7. Normal distribution. 8. Excess contributions plus earnings/excess deferrals (and/or earnings) taxable in 2024. 9. Cost of current life insurance protection. A. May be eligible for 10-year tax option (See Form 4972). B. Designated Roth account distribution. NOTE: If code B is in box 7 and an amount is reported in box 10, see the instructions . You use code 7 - Normal Distribution in box 7. There is not such code for 7 - Nondisability. That is something that OPM enters on the 1099-R and does not comply with the IRS approved codes for box 7. View solution in original post June 3, 2019 12:55 PM. 0 9 3,877 Reply. Bookmark Icon. 10 Replies DoninGA. Level 15 Mark as New; Bookmark;B and 2 are two separate codes and must be entered individually in the two drop-down boxes on TurboTax's 1099-R form. Codes B and 2 together mean that the distribution was from a Designated Roth Account in a qualified retirement plan (B) but is not subject to an early-distribution penalty despite you having been under age 59½ at the time of the distribution (2). Find the explanation for box 7 codes here. 2020 1099-R Box 7 Distribution Codes: 1 (1) Early . Annuity payments from nonqualified annuities and distributions from life insurance contracts that may be subject to tax under section 1411 (a distribution from any plan or arrangement not described in section 401(a), 403(a), 403(b), 408, 408A, or .

can i enter an electric box from the bottom

irs code 7d on 1099

Type 1 L SS Penta Bolt SS Fiat Washer X J 11 Type 1 Diamond Plate Frame Polypropylene Fibers Optional Ground Strap Not To Scale . Fogtite Incorporated Subject: Type 1 Junction Box Keywords: J-11 Type 1 L Type 1 Junction Box WSDOT Traffic Design Fogtite Created Date: 20160906220857Z .

irs box 7 distribution codes|form 1099 box 7 codes